Editorial

- Ukraine Economic Outlook

- Jul 16, 2024

- 6 min read

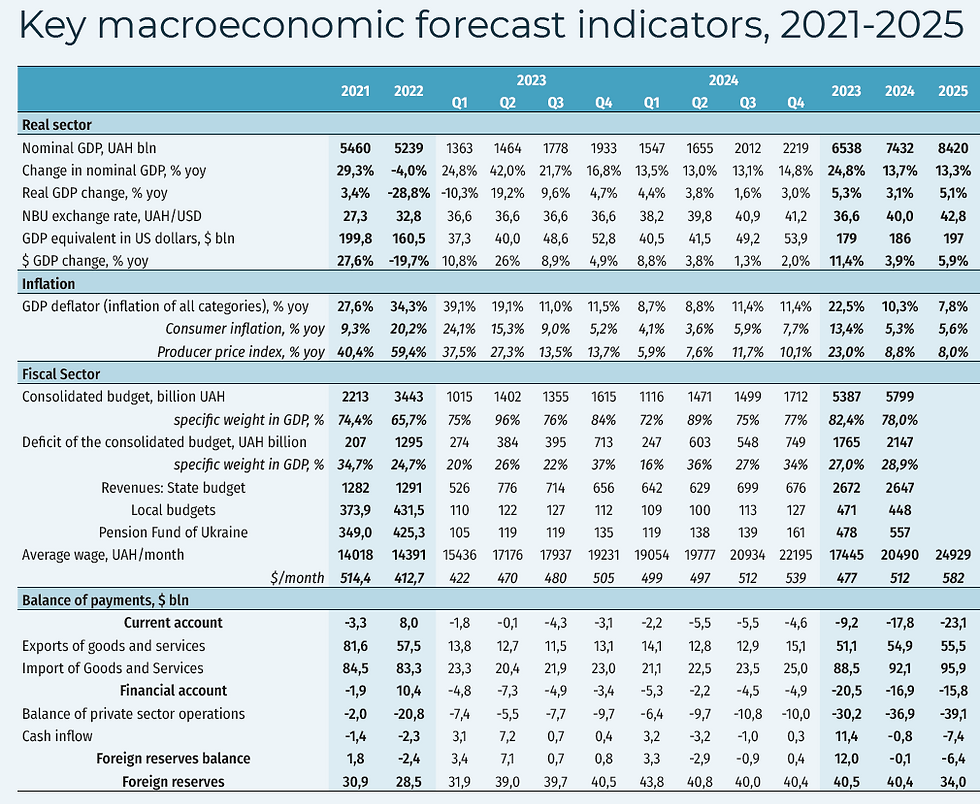

GDP. We maintain our real GDP growth forecast at 3% in 2024 (vs. a more optimistic estimate of 4.9% at the beginning of the year). This is driven by a series of Russian attacks on Ukraine’s energy system and a shortage of electricity, lower crop yields compared to 2023 and increased staff shortages.

The baseline assumptions of our macro forecast for 2024-2025:

• Combat actions with varying degrees of activity will continue through 2024-2025.

• Our diplomacy will be able to secure sustainable external financing from partners of at least $50 billion in 2024 and at about the same level of $40-50 billion in 2025.

• Unlocking the possibility of export by sea for the entire range of cargoes.

The main risk remains the stability of the energy infrastructure. Rocket attacks over the past two months by Russia have brought back blackouts in Ukraine, forcing a revision of all economic forecasts for the current year.

Energy security. Before the full-scale invasion of the Russian Federation, Ukraine’s domestic power generation amounted to about 55 GW. Now, according to the latest officially released data, Ukrainian generation capacity has fallen below 20 GW (-65-70%), of which about 9 GW has been eliminated since the beginning of spring 2024.

At the end of April, the Ukrainian Prime Minister announced that 80 CHP units (from USAID) have already been distributed to the regions, with Lithuania transferring equipment from its mothballed CHP plants and nuclear power plants from its warehouses, Britain providing over $180 million, and Germany providing 400 generators. The procedure for commissioning gas piston and gas turbine units was also simplified in order to speed up the deployment of a network of mini-CHPs (including for businesses) to accumulate a sufficient safety margin before the start of the new heating season. The President announced a plan to deploy an additional 1 GW of gas turbine power generation by the end of the year.

Thus, the system’s transition to decentralized generation and temporary shortage of electricity will primarily affect the acceleration of inflation (above the NBU target of 5%), as well as the increase in electricity imports and generation capacity.

External financing. The sensational news of the last month, which can completely remove the problem with external financing for 2024-25, guaranteeing its receipt in amounts much larger than Ukraine has requested so far, is the G7 decision to grant Ukraine a $50 billion loan from frozen Russian reserves with the possibility of receiving the funds in November-December 2024. This decision fully covers Ukraine’s external financing needs for 2024-2025.

But, as the experience of Q1 2024 has shown, arms supplies remain unstable due to internal political conflicts in the US. If there are also problems with this type of Western aid in 2025, it will have to be purchased at its own expense. This means that the estimate of Ukraine’s need for external financing at $40-50 billion a year may be insufficient. In any case, the increase in the defense budget will not come at the expense of redirecting funds earmarked for social expenditures. Since the additional purchases are made with foreign currency funds of the government, which are now stored in the reserves of the National Bank of Ukraine. As the example of January and May 2024 has shown, the IMF is calm about the use of foreign currency reserves for military needs in case of disruptions in the receipt of foreign aid.

Inflation. A significant slowdown in inflation in the first half of the year will reduce the average annual Consumer Price Index (CPI) to 5.3%, with an acceleration to 7-8% at the end of the year. The Producer Price Index (PPI) will average about 8-10% for the year. We still expect the GDP deflator, or the overall weighted average price change index, to be 10-11% in 2024.

Salaries. We lower our forecast for average wage growth in 2024 to 20.5k UAH, or about $512 (previous forecast $530), due to a general decline in business activity.

Budget. According to our forecast updated after the first five months, budget revenues will be over UAH 2.64 trillion (+50% of the plan), versus UAH 2.67 trillion in 2023 (-1%).

We also maintain the forecast of total state expenditures at UAH 4.3-4.4 trillion, against UAH 4 trillion in 2023 (+7-10%). Based on the fact that the final draft budget still envisages the expenditure part at the level of about UAH 3.3 trillion, the increase in the expenditure plan will occur as the revenue part is over-fulfilled along withexternal financing and charitable support throughout the year, as it happened last year (the draft for 2023 envisioned expenditures of UAH 2.6 trillion against the actual UAH 4 trillion, or +54%).

In January-May, the budget received $20 billion in external support from partners, of which $1 billion was provided as grants ($723 million from Japan and $295 million from Norway). By the end of the year it is expected to receive more than $30 billion.

Tax increase. The issue of tax increases remains at the center of the political debate in Ukraine. The Ministry of Finance, which submitted a conservative revenue forecast for the current year to the parliament and has to revise it upward every month based on the current performance, and the tax committee of the parliament insist on raising tax rates (VAT, military payroll tax, single tax for private entrepreneurs). They justify their position by the need to finance increased defense spending.

Opponents of tax increases cite chronic budget overruns in both taxes and grants from Western governments. They also point to the exceeding of the external financing plan (42bn dollars confirmed to date). And this is not counting the additional $50 billion allocated to Ukraine by the G-7, the timetable for receipt of which is still unknown. Opponents of the Finance Ministry consider any tax increase in the context of the impressive budget overshoot inappropriate due to the problems experienced by the private sector of the economy due to the war.

Balance of payments. Our forecast assumes the volume of exports of goods in 2024 at the level of $37.1 bln, imports - $68.8 bln (negative balance of trade in goods will amount to -$31.7 bln). Exports of services will increase to $17.8 bln. Imports of services will decrease to $23.2 bln. The balance of trade in goods and services at the end of the year will amount to -$37.2 bln (against -37.4 bln in 2023). The current account balance in 2024 will amount to -$17.8 billion (-9.6% of GDP), against -$18.5 billion (-10.3% of GDP) in 2023.

We estimate net inflows on the financial account at $16.9bn, of which -$12.2bn are private sector capital outflows and $29.2bn is the surplus of government borrowing. Thus, the main driver of capital outflows (private sector) is the increase in cash foreign exchange outside banks to $14.3bn and the effect of foreign exchange liberalization, which will lead to an outflow of $3.8bn on the financial account (out of $4.7bn). The aggregate deficit on private sector operations (current account, capital account and financial account) will amount to -$36.9 bln.

The balance of public sector operations in 2024 will amount to +$29.2 bln excluding grants (+$36 bln including them). As a result of the effect of foreign exchange liberalization with a decrease in expected attracted funds, we believe that a slight outflow of foreign exchange in 2024 (-$0.8bn) is possible.

Exchnange rate. Based on the fact that we expect inflationary pressures to intensify in the second half of 2024 (see Macro Indicators section for details), we assume that the NBU will not significantly weaken the hryvnia to avoid overflow into FX instruments. Given the current trend, at the end of Q2-Q3 2024 a new UAH corridor may be formed at 40.5-41.5 UAH/USD. At the end of the year, we expect the exchange rate to exceed 41.3 UAH/USD (+/- 1 UAH). The average annual rate in 2024 will be 40.0 UAH/USD.

However, such an assumption would primarily be based on stable international funding.

As for 2025, we estimate that the goods and services balance will deteriorate to -$40.4 billion, with merchandise exports remaining at $37.1 billion and imports rising to $72.2 billion. Meanwhile, services exports will rise to $18.4 billion due to a recovery in IT exports, while services imports will increase to $23.7 billion. Private sector financial account outflows will amount to $10.3 billion, of which the purchase of foreign currency cash by households will grow to $14.7 billion. Total borrowings in 2025, based on the scenario of continued active hostilities throughout the year and the persistence of a significant budget deficit, are estimated at $40.4 billion.

In 2025, apart from possible risks related to international financing, an important part of the pressure on the market will be an increase in the deficit on private sector transactions to $39.1bn (from $36.9bn), which will lead to an expansion of demand for foreign exchange (mainly for imports/purchases by households). Under these conditions, under the baseline scenario of continued trend of international financing, we expect devaluation of the average annual exchange rate to 42.8 UAH/USD (+/- 2 UAH/USD). This forecast is calculated under the scenario that the NBU will stick to its current policy of smooth devaluation. However, the G-7 decision to allocate additional $50 bln may change the

NBU’s priorities in exchange rate policy, forcing it to return from the current scenario of smooth devaluation of 7-10% per year to the inflation targeting scenario, when in the conditions of excessive inflow of external financing with a surplus of more than $10 bln per year, the NBU can keep the exchange rate stable for 2025 and buy excess currency in reserves.

Source: State Statistics Service, NBU, UEO own calculations

Comments